If You Want to Invest in Stock, Read This.

When it comes to the best-beginner stock picking, the authors of these books absolutely nailed it but more from the investor...

Before you continue, I have created a Google Doc file and found a Peter Lynch playbook online, you may want to refer to those files for quick reference,

Good day—it's time to stock up!

I've had it. Every minute, my phone lights up with "hot stock tips." Notifications pop up like clockwork, from "can't-miss" buy alerts to insider whispers on stocks that'll supposedly make us rich. They're everywhere:

—

3 Growth Stocks That Have Generated 1000% Returns Since The Last Presidential Elections

Don’t miss the next 100-bagger: Buy NOW!

ABC Company: Time To Get Out! (NYSE:ABC)

—

It's amusing, really, especially the last one. They even tell us when to bail on a stock. We've got recommendations coming from journalists who have "no right" to give advice, yet somehow these articles keep appearing, filled with bold calls and the occasional "I told you so" moment. Everyone's a genius in hindsight: "I predicted that stock surge" or "get in now before it's too late!"

And so, we're nudged—or downright cornered—into making decisions that should be ours alone. We're sucked into this noise we can't seem to escape. Social media amplifies it tenfold, and even though we know better, the temptation to follow these buy-sell signals just keeps growing.

My best decisions came when I ignored the hype and focused on quieter companies (or real-growth companies with hype that died down). Today’s investing landscape is rife with distractions; mobile brokerage apps feature not just buy or sell options but also enticing “Posts” and “News” sections filled with peer opinions. When facing strong, often extreme, contrary views, reevaluating my approach can feel unavoidable.

So how do we make the right call in the middle of all this? There are practical, time-tested ways to pick stocks, and today we're diving into a book from one of the prominent fund managers during his time at Magellan Fund averaged 29.2% returns.

The Lynch Way

The author doesn't just give advice; he lays out stock-picking in a straightforward way anyone can follow. Instead of calling it "stocks," he emphasizes buying businesses—real companies with value beyond fleeting popularity. This distinction matters because "stocks" can feel like gambling, especially if you've seen the dot-com bubble and 2008 financial crisis play out firsthand.

Sticking to the fundamentals, he offers a clear and simple guide for individual investors—metrics to watch, qualities to prioritize, and, most importantly, why these factors matter. He breaks it down in such a way that even a five-year-old could understand the basics.

This is investing done right—practical and grounded through art, science, and legwork, beyond the noise.

On a personal side of notes…

While I greatly admire Peter Lynch and his method, I can’t fathom holding thousands of stocks in my portfolio—or even more than twenty, to be honest. The part where he purchased over a hundred stocks during a bear market? That just doesn't align with my style.

Don't get me wrong; I'm still a huge fan of his stock-picking method. But my approach is more along the lines of "pick a few stocks" you're deeply confident in and diversify by industry in areas you know well.

In this article, I hope you'll also cherry-pick the insights that resonate with you rather than trying to grasp everything all at once.

The Lynch Legacy

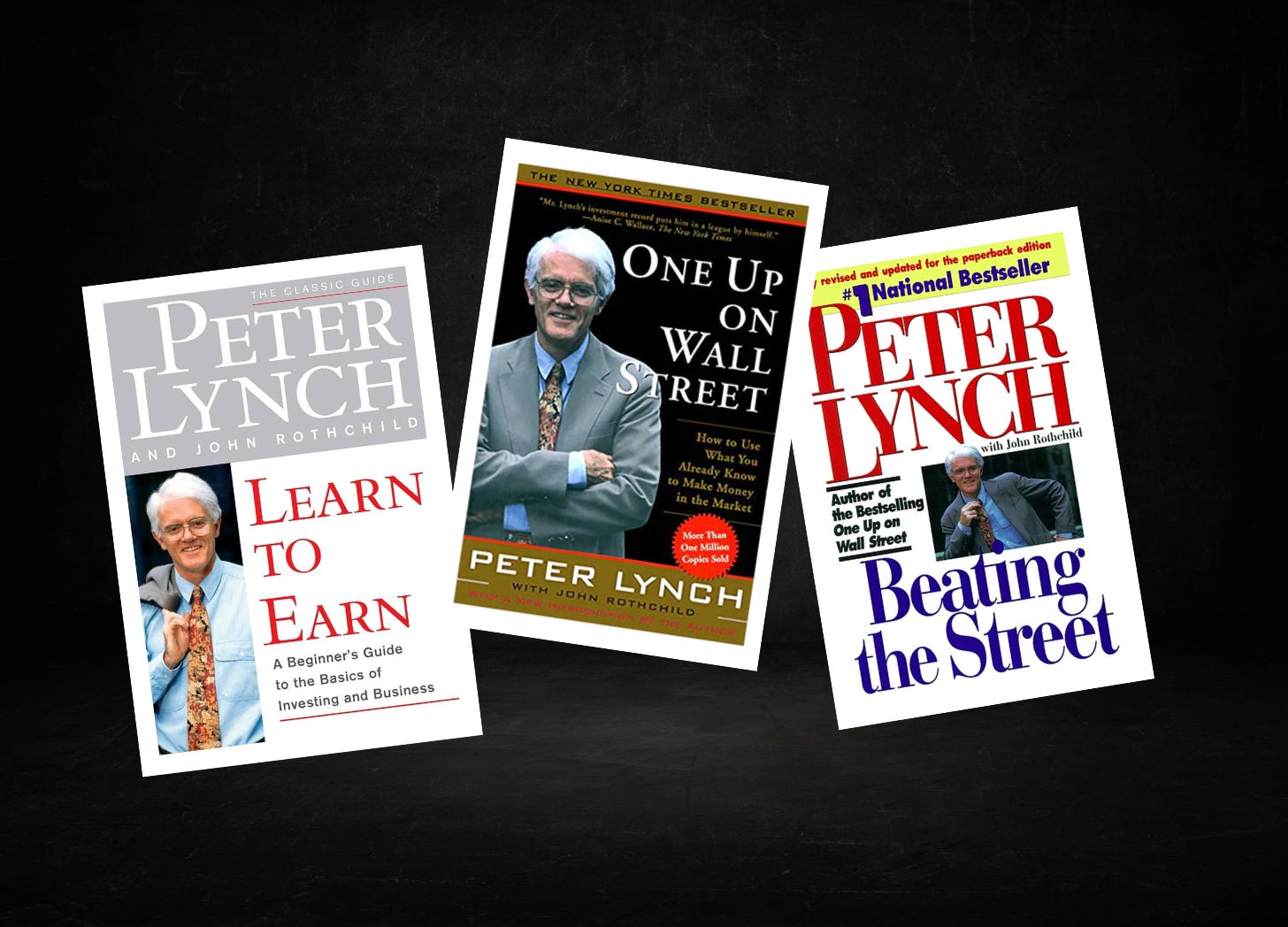

This piece is a tribute to Peter Lynch's work and the powerful lessons in his books on how "dumb money" can pick stocks like the pros. This is a distilled summary from his three classic works: One Up on Wall Street, Beating the Street, and Learn to Earn.

Think of this as a no-nonsense guide, drawn from years of investing experience and a fresh reread of Lynch's golden rules on investing.

To All Readers

I've decided to blend the content from each of Peter Lynch's books here to make learning easier.

Investing in Stock

I'm not here to tell you why you should invest in stocks but to dive into how to do it—whether you're new, an amateur, or a seasoned investor. This guide is built on Peter Lynch's core principles (with a little of my own twist).

An amateur who devotes a small amount of study, … can outperform 95 percent of the paid experts who manages the mutual funds, plus have fun in doing it.

— Peter Lynch, Beating the Street

Here’s a surprising fact:

A group of 13-year-old students from St. Agnes managed to generate a stunning 70% return while the S&P 500 rose only 26% in the same period. What’s more, their stock picks even outperformed 99% of all equity mutual funds globally.

So, do you still think you need a finance expert or insurance manager to oversee your portfolio? Maybe not.

You can be the world’s greatest expert on balance sheets or p/e ratios, but without faith, you’ll tend to believe the negative headlines.

— Peter Lynch, Beating the Street

If these teenagers could do it, so can you. Investing doesn't require a "genius" mindset or a perfectly crafted Excel sheet that tracks 10-year financial statements. Just like studying for an exam, knowing what you're getting into can make all the difference.

Enjoy Stochastic Gains?

I’ll be posting more and diving deep into my investment strategies, thought processes, and providing valuable content on personal growth, stock market analysis, fundamental research, and books recommendation!

You'll get a closer look at how I approach investing and life, with fresh perspectives that can help you navigate both.

Up next?

Upcoming topics I'm exploring in Stochastic manner:

After [_] years of self-battle, I am finally freed

In the 2000s, It’s Amazon, Today It’s [_]!

Here are The Top [_] books I recommend for Finance!

Want in? Subscribe for more!

Beating the Professionals at Their Game 🤵🏻

The only way to outperform the professionals is by having an edge in areas they don't. Knowing what you know, that's your secret weapon – they don't have access to your unique perspective. Otherwise, you might seriously be considering if they installed mind-reading technology in your brain (though who knows these days). On a second thought, how do they keep track of those?

If you have been investing in stocks with no strategy or tactic (basically tactless), you will come to see that somehow the smart money seems to "know" your move. Well, they are exploiting human nature, psychology, and emotions—for the most part. But you constantly blame Mr. Market for your mistakes.

This brings us to the core question: how can you consistently choose winning stocks and, ideally, outperform the market (the professionals)?

For the many 👨👨👦👦

While I typically advocate for individual stock picking (for those who have the knack), I also recognize that not everyone has the time or desire for direct selection. Thus, let’s consider an equally valid alternative: strategic fund picking. Here are the three pillars of successful fund investing:

Choosing an industry (you specialise in or know-well)

Identifying Fund types (Capital appreciation, Value, Quality Growth, Emerging Growth and Special Situations)

Learning to compare funds effectively

Choosing an industry 🛠️

Get this firmly into your mind: only pick stock funds that focus on your industry or, at the very least, the standard broad market (S&P indexes such as VOO, SPY).

You don’t need to be an expert to invest in stocks; this holds even truer for stock funds. A stock fund can simply comprise all the stocks in your respective industry. This approach allows you to bypass the complex research and seamlessly transition to the next strategy, which is...

*Stock funds refers to indexes, mutual funds and ETFs that consist only 100% equities.

Determining the Fund Types 🌱

I hate to break it to you, but even fund types aren't universally tailored to cater to everyone’s investing style—there's no such thing as “the best.” Keep in mind:

…markets change and conditions change and one style of manager or one kind of fund will not succeed in all seasons… A value fund, for instance, can be a wonderful performer for three years and awful for the next six.

— Peter Lynch, Beating the Street

So, it’s prudent to identify what kind of investor you are: aggressive or defensive.

The fund types derive from their names. The trick is that none are inherently the best or worst; they simply serve as tools that align with your personal investing goals and the risks you are willing to assume. As the saying goes:

"A conservative will never seek high return, high risk, likewise an aggressive will not seek a low return and low risk."

The only message that I can bring across: all fund types have their cycle. It's important as a reader you would find this out by understanding their performance, which brings me to the next point...

Comparison between funds

This is a pointless exercise, unless done right.

So to say, any stock funds can outperform any. The basis on why it outperforms is very important (that's the comparison we should seek).

Here's why you can see, I'm not a huge fan of looking at past performance (as many literally look at the past performance 327% over the past 10 years, what about -50% in the next 5 years).

The right way of comparing

Here’s the right way to compare:

1. Benchmark (in YoY percentage) 📊

In comparison to its peers, because a stock fund can generate 18% in its good years but a rare fall of 30% in bad years, whereas its peers produce 13% in good years but a rare fall of 10% in bad years. I will pick the latter since its performance is more steady and consistent; the losses will deem insignificant.

2. P/E ratio 📈

The general guideline for broad market indexes or ETF like S&P500(VOO, SPY) that invest in multiple industry is:

<15 (undervaluation or that the market expects slower growth or a potential recession.

15-20 (Solid Benchmark)

>20 (signal overvaluation, especially if accompanied by low growth forecasts.)

For industry-specific PE ratios, refer to this.

3. Concentration of the portfolio 🎯

You might not realize it, but it’s crucial to review the stock holdings of index funds (unless it's S&P 500 or any broad-market funds). This is essential since you could be dealing with unwanted stocks or heavily concentrated industries you may not understand. It’s wise to steer clear of any such risk, even if it aligns with other metrics.

“The only fair point of comparison is one value fund versus another… If one type of fund outperform another fund, it’s no reflection on the fund but a reflection on the style of investing.”

It may even be pointless to start “jumping from the value fund to a growth fund just as value is starting to wax and growth is starting to wane.”

— Peter Lynch, Beating the Market

In short, for many investors:

Don't spend too much time analyzing past performance charts. It's better to stick with a steady and consistent performer than to constantly jump between funds, trying to catch all the highs.

Here’s for less

For those interested in stock picking, here are two strategies I would employ if I were starting anew (with a focus purely on stocks):

1. Handpicked Stocks along Stock Funds (mostly) ✊🏻

I'll admit, I'm not the biggest fan of leaning on stock funds alone, but there's practicality in this approach—it’s accessible and adaptable for nearly anyone.

How This Works: Stick with the "stock funds strategy" we discussed for broader stability. Add a handful of individual stocks you genuinely believe in, ones you know well. This approach lets you diversify with intention, what I call "selective diversification."

Here's the formula: We all know of Pareto Principle (80/20 rules), to keep things easy, we use them here → aim for 80% in stock funds and 20% in handpicked stocks. Despite being 100% in stocks, there’s a diversity here.

🚨 Note to reader: Having 80% in benchmark funds doesn't automatically guarantee benchmark returns. Remember, you're still 20% (or more) away from the benchmark due to potential investing mistakes and habits.

Why This Works

Number 1: You’re already in good hands 👍🏻

By investing primarily in selective stock funds, you're positioning yourself close to benchmark indexes like the S&P 500, leveraging broader market growth without undue risk

You maintain an edge by picking stocks within your expertise—think products you use daily or industries you work in. Who knows these better: the professional analyzing spreadsheets, or you with direct experience?

Diversification, Without “Di-Worsification” 🪴

Stock funds provide a basket of quality holdings, helping you sleep better at night

You're exposed to systematic risk rather than unsystematic risk

Remember to do basic homework on fund selection (as covered in the earlier section)

You dedicate small part of your time into researching ⌛

Stock picking becomes more manageable—fewer stories to track means more time for quality analysis

With 80% already tracking the benchmark, you can focus your energy on making that 20% count

2. Stockpicker: Portfolio made of individual stocks 🤏🏻

This approach is bolder. For those who relish the thrill of stock picking (like me), you'll enjoy the process as much as the results. Your toolkit? A computer, brokerage account, spreadsheet (for non-hobbyist), and notebook.

—

You are your own industry-expert 🏆

Forget Wall Street experts with their flashy presentations—become a industry expert through firsthand experience. I learned this while working retail at eighteen, grasping customer behavior and purchasing patterns. That insight proved invaluable for identifying investment opportunities.

Leverage your industry knowledge as your differentiator. Nothing compares to knowing your field through direct experience with products and services.

—

📕 Keeping a notebook of stories

…investments not as disconnected events, but continuing sagas, which need to be rechecked from time to time for new twists and turns in the plots. Unless a company goes bankrupt, the story is never over…

— Peter Lynch, Beating the Street

Keep a notebook documenting your investment thesis for each company. Make it straightforward and review regularly. Think of each investment as an ongoing story—if the plot still makes sense, keep holding or add more.

Pro Tip: Record key points from quarterly and annual reports, plus your buy/sell reasoning.

—

💬 Avoid the Noise

I learned this lesson the hard way: discussing investment decisions can warp your conviction. Once, I talked myself out of a stock just by debating it with a friend. Don't over-discuss your investments, especially during crucial decision points. Remember, you alone are responsible for your trades.

The real key to making money in stocks is not to get scared out of them.

— Peter Lynch, One Up on Wall Street

Pro Tip: Avoid news and comments on mobile brokerage app, that provides some random stock tips. Focus on educated, researched decisions.

—

🤝🏻 The Fifth-Grader Test

Can you explain your investment in 90 seconds to a fifth-grader? No jargon, no buzzwords. If not, keep refining your reasoning. When everyone can understand your logic without counterarguments (and the fundamentals are sound), you're on solid ground.

If you’re prepared to invest in a company, then you ought to be able to explain why in simple language that a fifth grader could understand.

— Peter Lynch, One Up on Wall Street

—

📶 Understand Industry-specific metrics

This one’s a challenge. Each industry has its own crucial metrics, and understanding them can be your edge. Peter Lynch famously said,

“If all the information you needed was in the balance sheet, then the richest people would be accountants.” — Peter Lynch (One Up on Wall Street)

Knowing these key metrics won’t come overnight, but with practice, you’ll start developing an intuitive sense of whether a stock has potential. You could say this is both art and science to investing.

Here’s to the link I wrote about industry-specifics metrics, which will serve you well if you already know how to calculate those numbers. :)

—

🚩 Red flags & triggers

Stay skeptical. Remember that companies ultimately depend on management, competitive advantage, and debt management. Don't let emotions cloud your judgment—a charismatic CEO doesn't guarantee business success. Focus on the reality reflected in both financial statements and business performance.

Go for a business that any idiot can run – because sooner or later, any idiot is probably going to be running it.

— Peter Lynch, One Up on Wall Street

Tips: Review the old video of the companies and see how their “promises” story evolves, look at the their past annual or quarterly report, how their forward-looking statements turns out in comparison to the present. You get it.

The Bottom Line

Stock picking doesn’t have to be as intricate as “smart money” makes it appear. Whether you choose the balanced 80/20 approach or dive fully into individual stocks, success comes down to a few fundamental principles:

Play to Your Strengths: Your greatest advantage isn’t rooted in complex financial models—it lies in your personal knowledge and experience. Whether you’re embedded in retail, tech, or healthcare, your industry perspectives are invaluable tools that most “smart money” analysts cannot replicate.

Keep It Simple and Personal: The best investment strategy is one you can realistically commit to. This is why the 80/20 approach resonates for many—it integrates the stability of funds with the engagement of personal stock picking. For others, a focused portfolio of well-researched individual stocks might be the ideal path. Either way, choose the trajectory that aligns with your temperament and time investment.

Document Your Journey: Whether through investment journals or straightforward stock stories, recording your investment thesis keeps you anchored when markets get turbulent. If you can’t explain why you hold a position in seconds, you may not understand it thoroughly.

Trust Your Research, Not the Noise: The market is full of tips, trends, and "can't-miss" opportunities. But real investing success comes from thorough research and personal conviction, not from following the crowd.

You Can Always Consider Stock Funds: Investing in stocks isn’t the only route to stock market exposure; stock funds accomplish precisely that with reduced risk. Simplicity doesn’t equal a lack of research; unless you’re tracking a broad index, due diligence is paramount

Remember, becoming a successful investor is a journey, not a destination. It's about developing your own approach, learning from both successes and mistakes, and constantly refining your process. Whether you're managing a handful of carefully chosen stocks or balancing funds with personal picks, the key is staying true to your strategy while remaining open to learning.

Start with what you know, stick to what you understand, and let your investing approach evolve with your experience. After all, the best investment strategy isn't necessarily the most sophisticated one—it's the one you can confidently execute year after year.

Disclaimer: The information provided above should not be considered financial advice. This content is for informational purposes only and does not constitute a recommendation to buy or sell any securities. Readers are encouraged to conduct their own research and due diligence before making any investment decisions.

If you like what you read

Check out our other posts!

Related:

Supermicro Stock Analysis: The AI Revolution's Underdog Shovel or a Risky Bet?

Why I’ve Never Invested in Index Funds/ETFs or Big-Name Stocks (But Should You?)

Do consider subscribing for more of these content :)